Withdraw & Send In Uganda

Airtel Mobile Money Withdraw Sending Charges Uganda are levied on transactions initiated by individuals withdrawing funds from their Airtel Money accounts and sending them to other individuals. For instance, if a customer withdraws 100,000 Ugandan shillings and sends it to another Airtel Money user, a certain fee applies.

These charges are significant as they impact the overall cost of using Airtel Mobile Money services. They provide revenue for Airtel Uganda, enabling them to invest in network infrastructure and improve service delivery. Historically, these charges have evolved over time, with Airtel Uganda adjusting them based on market dynamics and customer feedback.

This article delves into the factors that influence Airtel Mobile Money Withdraw Sending Charges Uganda, analyzes their impact on customers, and explores the regulatory framework surrounding these charges.

Airtel Mobile Money Withdraw Sending Charges Uganda

The essential aspects of Airtel Mobile Money Withdraw Sending Charges Uganda encompass various facets, including:

- Transaction Limits

- Transaction Fees

- Transaction Processing Time

- Convenience and Accessibility

- Impact on Financial Inclusion

- Regulatory Framework

- Customer Protection Measures

- Market Competition

These aspects shape the overall experience of using Airtel Mobile Money services, impact customer decisions, and influence the broader financial landscape.

Transaction Limits

Transaction limits play a crucial role in shaping Airtel Mobile Money Withdraw Sending Charges Uganda by determining the amount of money that customers can withdraw or send at a particular time. These limits are implemented for various reasons and have several key aspects:

- Daily Transaction Limit

This limit sets a maximum amount that a customer can withdraw or send via Airtel Mobile Money within a 24-hour period. It helps regulate the flow of funds and manage potential financial risks.

- Weekly Transaction Limit

Similar to the daily limit, the weekly limit imposes a maximum amount that a customer can transact over a seven-day period. It provides an additional layer of control and prevents excessive transactions.

- Monthly Transaction Limit

The monthly transaction limit establishes a cap on the total amount that a customer can withdraw or send within a calendar month. This limit helps prevent money laundering and other illicit activities.

- Transaction Limit by Channel

Airtel Uganda may set different transaction limits for various channels, such as mobile app, USSD, and agent banking. This differentiation allows Airtel to optimize security and manage transaction costs.

Transaction limits impact customers by influencing their ability to access and use their funds. They also affect Airtel Uganda's revenue and operational costs. The company must carefully balance these factors to ensure the security and efficiency of its Mobile Money services.

Transaction Fees

Transaction fees play a pivotal role in determining Airtel Mobile Money Withdraw Sending Charges Uganda. When a customer withdraws or sends money via Airtel Mobile Money, they incur a fee that contributes to the overall cost of the transaction. Understanding the connection between these two elements is crucial for analyzing the financial implications and regulatory framework surrounding mobile money services.

Transaction fees are a critical component of Airtel Mobile Money Withdraw Sending Charges Uganda because they generate revenue for Airtel Uganda, enabling the company to cover operational costs, invest in network infrastructure, and provide quality services to its customers. Without transaction fees, Airtel Uganda would struggle to sustain its Mobile Money operations and maintain the reliability and security of its platform.

Real-life examples of transaction fees within Airtel Mobile Money Withdraw Sending Charges Uganda vary depending on the amount being withdrawn or sent, the transaction channel used, and the customer's subscription plan. For instance, withdrawing 100,000 Ugandan shillings from an Airtel Money agent may attract a fee of 1,000 shillings, while sending the same amount to another Airtel Money user via the mobile app may incur a fee of 500 shillings.

Understanding the relationship between transaction fees and Airtel Mobile Money Withdraw Sending Charges Uganda is essential for customers to make informed decisions about their mobile money usage. By considering the fees associated with different transactions, customers can optimize their financial management and minimize unnecessary expenses. Regulators also utilize this understanding to develop policies that balance the need for revenue generation with the promotion of financial inclusion and consumer protection.

Transaction Processing Time

Transaction Processing Time is a crucial aspect of Airtel Mobile Money Withdraw Sending Charges Uganda, influencing the overall efficiency and convenience of the service. It encompasses the time taken for a withdrawal or sending transaction to be completed and credited to the recipient's account. Understanding the various facets of Transaction Processing Time is essential for customers to make informed decisions and optimize their mobile money usage.

- Network Availability

The availability and stability of Airtel's network infrastructure play a significant role in Transaction Processing Time. Strong network coverage ensures faster transaction processing, while network congestion or outages can lead to delays.

- Transaction Volume

The volume of transactions being processed at any given time can impact Transaction Processing Time. During peak hours or periods of high demand, such as during holidays or promotional campaigns, transaction processing may take longer.

- System Maintenance

Scheduled or unscheduled system maintenance activities can temporarily affect Transaction Processing Time. Airtel Uganda typically communicates planned maintenance windows to minimize disruptions for customers.

- Transaction Verification

Airtel Uganda employs various security measures to prevent fraud and unauthorized transactions. These measures, such as PIN verification or OTP authentication, may add an additional layer of processing time to ensure the safety of customer funds.

Transaction Processing Time has a direct impact on the overall customer experience and satisfaction with Airtel Mobile Money services. Faster processing times enhance convenience and encourage frequent usage, while delays can lead to frustration and hinder adoption. Airtel Uganda continuously invests in network upgrades and system optimizations to minimize Transaction Processing Time and provide a seamless experience for its customers.

Convenience and Accessibility

Convenience and Accessibility play a pivotal role in shaping Airtel Mobile Money Withdraw Sending Charges Uganda by influencing customer adoption, usage patterns, and overall satisfaction with the service. Understanding the relationship between these two elements is crucial for analyzing the success and impact of Airtel Mobile Money in Uganda.

Convenience refers to the ease and simplicity of using Airtel Mobile Money services. Airtel Uganda has made significant efforts to enhance convenience by offering a range of transaction channels, including mobile app, USSD, and agent banking. This allows customers to access their funds and perform transactions anytime, anywhere, without the need for traditional banking infrastructure.

Accessibility, on the other hand, refers to the availability and reach of Airtel Mobile Money services across Uganda. Airtel Uganda has invested heavily in expanding its network coverage and agent network, ensuring that customers in even the most remote areas can access Mobile Money services. This accessibility has been instrumental in driving financial inclusion and promoting economic development in Uganda.

The combination of Convenience and Accessibility has made Airtel Mobile Money a preferred choice for Ugandans, contributing to its widespread adoption. The ease of use and wide reach of the service have enabled customers to embrace mobile money as a convenient and reliable way to manage their finances, send and receive payments, and access financial services.

Impact on Financial Inclusion

Airtel Mobile Money Withdraw Sending Charges Uganda have a direct impact on financial inclusion in the country. Financial inclusion refers to the ability of individuals and businesses to access and use formal financial services, such as savings accounts, loans, and insurance. By making it easier and more affordable for Ugandans to send and receive money, Airtel Mobile Money contributes to financial inclusion in several ways:

- Reduced Transaction Costs

Airtel Mobile Money Withdraw Sending Charges Uganda are generally lower than traditional banking fees. This makes it more affordable for low-income individuals and those living in rural areas to access financial services.

- Increased Access Points

Airtel Mobile Money agents are widely available throughout Uganda, even in remote areas where traditional banking services are limited. This increased access makes it easier for people to deposit, withdraw, and send money, regardless of their location.

- Simplified Account Opening

Opening an Airtel Mobile Money account is simple and requires minimal documentation. This makes it accessible to individuals who may not have formal identification or traditional banking history.

The impact of Airtel Mobile Money Withdraw Sending Charges Uganda on financial inclusion is evident in the increased usage of mobile money services in Uganda. According to the Uganda Communications Commission, over 90% of adult Ugandans now have access to mobile money services, and over 70% use them regularly. This widespread adoption has led to increased financial inclusion and economic empowerment, particularly for women and rural communities.

Regulatory Framework

Regulatory Framework plays a critical role in shaping Airtel Mobile Money Withdraw Sending Charges Uganda. It establishes the rules and guidelines that govern the operations of mobile money services, ensuring consumer protection, market stability, and compliance with anti-money laundering and counter-terrorism financing regulations.

- Licensing and Registration

The regulatory framework requires Airtel Uganda to obtain a license from the Bank of Uganda to operate as a mobile money service provider. This license outlines the conditions and obligations that Airtel must adhere to, including adherence to transaction fee guidelines and customer protection measures.

- Transaction Limits

The regulatory framework may impose limits on the amount of money that can be withdrawn or sent via Airtel Mobile Money. These limits are designed to prevent money laundering and other illicit activities, and may vary depending on factors such as customer identity verification and transaction risk assessment.

- Consumer Protection

The regulatory framework includes measures to protect consumers from fraud, unauthorized transactions, and other risks associated with mobile money services. These measures may include requirements for strong customer authentication, transaction confirmation mechanisms, and dispute resolution procedures.

- Anti-Money Laundering and Counter-Terrorism Financing

The regulatory framework imposes obligations on Airtel Uganda to implement measures to prevent and detect money laundering and terrorism financing activities. These measures may include customer due diligence, transaction monitoring, and reporting suspicious transactions to the relevant authorities.

The regulatory framework for Airtel Mobile Money Withdraw Sending Charges Uganda is designed to balance the need for consumer protection and market stability with the promotion of financial inclusion and innovation. By adhering to these regulations, Airtel Uganda ensures the safety, reliability, and integrity of its Mobile Money services.

Customer Protection Measures

Customer Protection Measures are an integral part of Airtel Mobile Money Withdraw Sending Charges Uganda, ensuring the safety and security of customer transactions. These measures are designed to protect customers from fraudulent activities, unauthorized access to their accounts, and other risks associated with mobile money transactions.

Customer Protection Measures play a critical role in building trust and confidence in Airtel Mobile Money services. By implementing robust safeguards, Airtel Uganda demonstrates its commitment to protecting customer funds and data. These measures include:

- Strong Customer Authentication: Airtel Mobile Money employs multiple layers of authentication to verify customer identity during transactions. This includes PIN verification, biometric authentication, and OTP-based confirmation.

- Transaction Monitoring: Airtel Uganda monitors transactions in real-time to detect suspicious activities. Advanced fraud detection systems identify and flag unusual patterns or high-risk transactions for further investigation.

- Dispute Resolution Mechanisms: Customers can report unauthorized or fraudulent transactions to Airtel Uganda's customer care team. The company has established clear processes for investigating disputes and resolving them promptly and fairly.

Effective Customer Protection Measures are essential for the long-term success of Airtel Mobile Money services. They provide customers with peace of mind, knowing that their funds are safe and secure. This trust and confidence encourage customers to use Mobile Money services frequently, contributing to financial inclusion and economic development in Uganda.

Market Competition

Market Competition is a critical factor influencing Airtel Mobile Money Withdraw Sending Charges Uganda. In a competitive market, Airtel Uganda is under pressure to offer competitive fees to attract and retain customers. This competition drives innovation and efficiency within the mobile money industry, benefiting customers.

One key aspect of market competition is the presence of multiple mobile money providers in Uganda. Airtel Uganda competes with other telecom operators, such as MTN Uganda and Uganda Telecom, as well as non-telecom companies like EcoCash and Wave Mobile Money. This competition forces Airtel Uganda to optimize its pricing strategy, ensuring that its charges are aligned with or lower than those of its competitors.

For instance, if MTN Uganda introduces a new promotion offering lower transaction fees, Airtel Uganda may respond by reducing its own fees to match or undercut MTN's offer. This competitive dynamic keeps transaction charges in check, ensuring that customers have access to affordable mobile money services.

Understanding the relationship between Market Competition and Airtel Mobile Money Withdraw Sending Charges Uganda is essential for stakeholders in the mobile money industry. Regulators can use this understanding to promote fair competition and ensure that consumers benefit from competitive pricing. Mobile money providers can use it to develop pricing strategies that balance profitability with market share considerations. Customers can use it to make informed decisions about which mobile money provider to use based on factors such as transaction fees and service quality.

Airtel Mobile Money Withdraw Sending Charges Uganda are influenced by multiple factors, including transaction limits, transaction fees, transaction processing time, convenience and accessibility, impact on financial inclusion, regulatory framework, customer protection measures, and market competition. These factors are interconnected and shape the overall cost and user experience of Airtel Mobile Money services.

Key findings from our exploration of Airtel Mobile Money Withdraw Sending Charges Uganda include:

- Transaction fees contribute to the revenue model of Airtel Uganda, enabling the company to invest in network infrastructure and service improvements.

- Convenience and accessibility are crucial for driving adoption and usage of Airtel Mobile Money services, particularly in remote areas and for financially excluded populations.

- Market competition plays a significant role in keeping transaction charges competitive and affordable for customers.

Understanding the dynamics of Airtel Mobile Money Withdraw Sending Charges Uganda is essential for stakeholders, including customers, regulators, and mobile money providers. By optimizing these charges and related factors, Airtel Uganda can continue to provide accessible, affordable, and secure mobile money services that contribute to financial inclusion and economic development in Uganda.

How Kirsten Storms Gained Weight: A Comprehensive Review

How Did Roy White S Wife Die

Decoding Business Career: Unveiling The Factors Shaping Income, Age, And Relationships

JOINT STATEMENT ON CHANGES IN MTN & AIRTEL MOBILE MONEY RATES Entebbe

MTN Mobile Money sending charges/rates in Uganda 2019 SautiTech

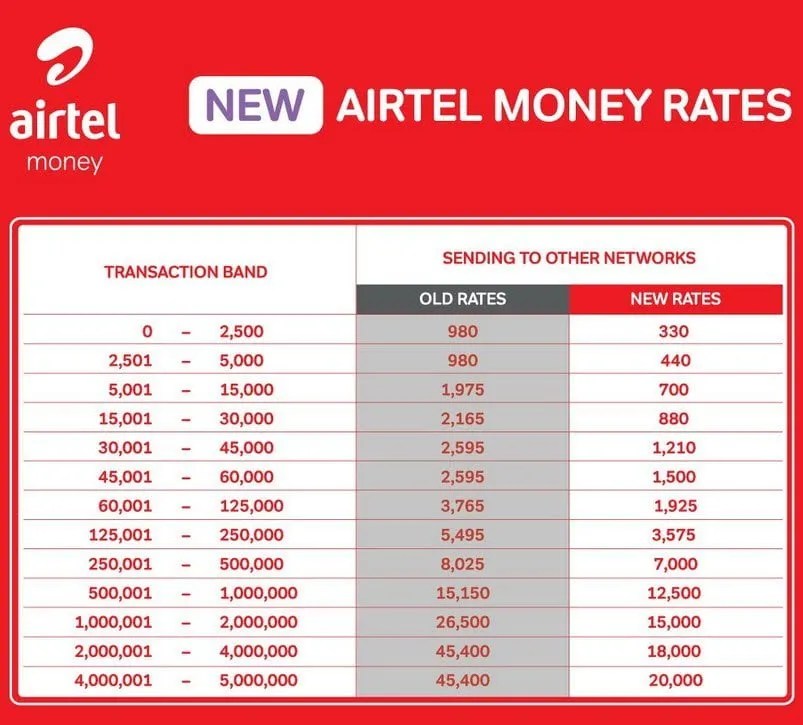

The Airtel Money rates 2022 Techjaja

ncG1vNJzZmiZnaKuprPOnZueZqNoe7a%2FjLCcrKxdZ3uiucCzpqeZp6h7pLvMaJiiqqSauW65zpugpZ1doryvsdhmrqKsmJm%2FosOMrJynnJmjtG6vx5qpoJ2jYsKorc2dmGegpKK5